The government of India has made it mandatory to link your PAN with your Aadhaar card. The updated deadline for linking PAN and Aadhar is closing in and you are gone through the same confusion as many out there about if your PAN and Aadhar are already linked? If not, how to do the same?

Coconuts to the rescue.

Steps to check if PAN and Aadhar are already linked

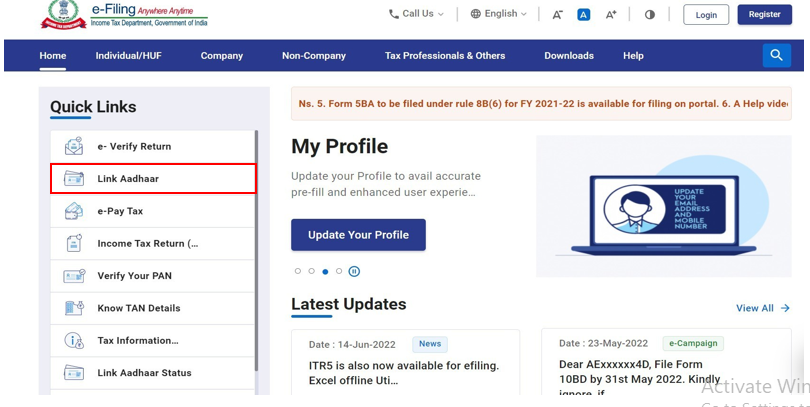

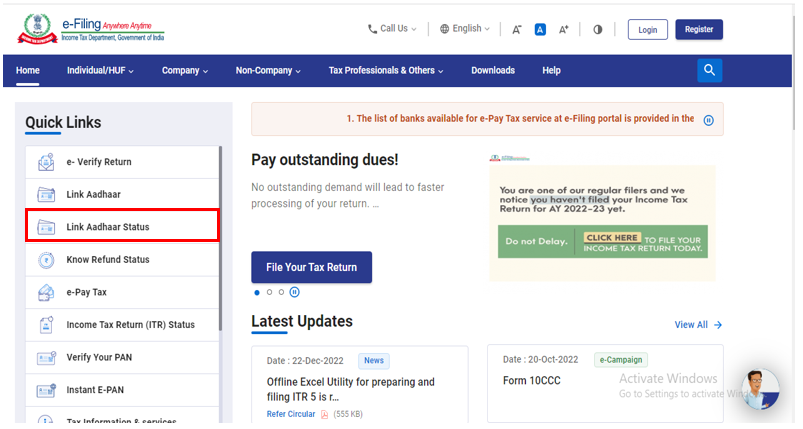

- Navigate to Home | Income Tax Department

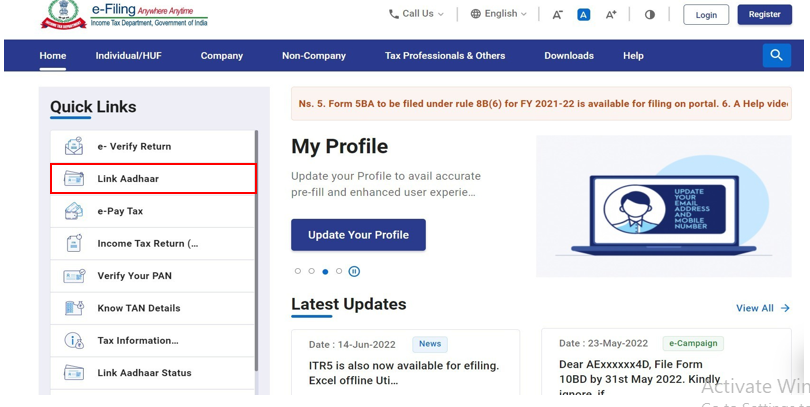

- Click on Link Aadhar as seen in the image below

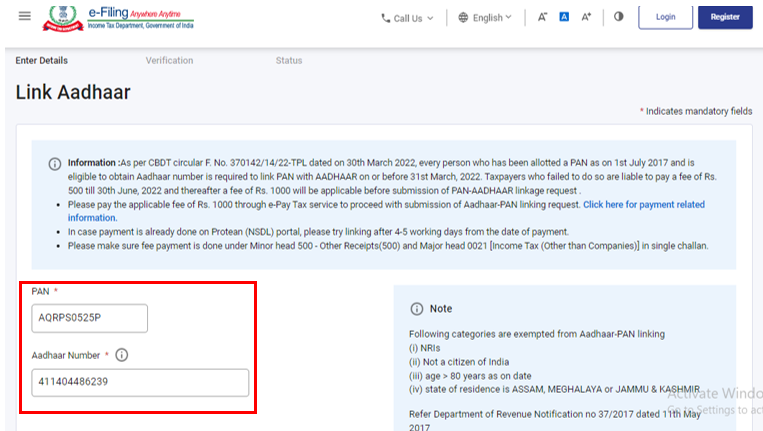

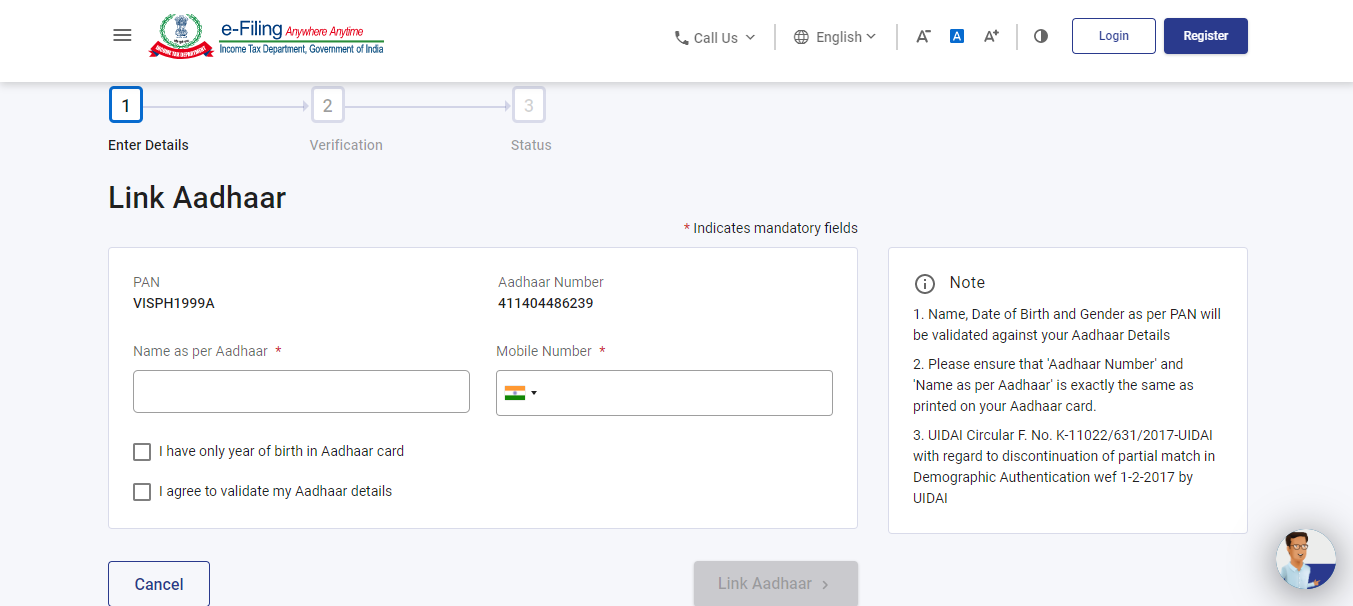

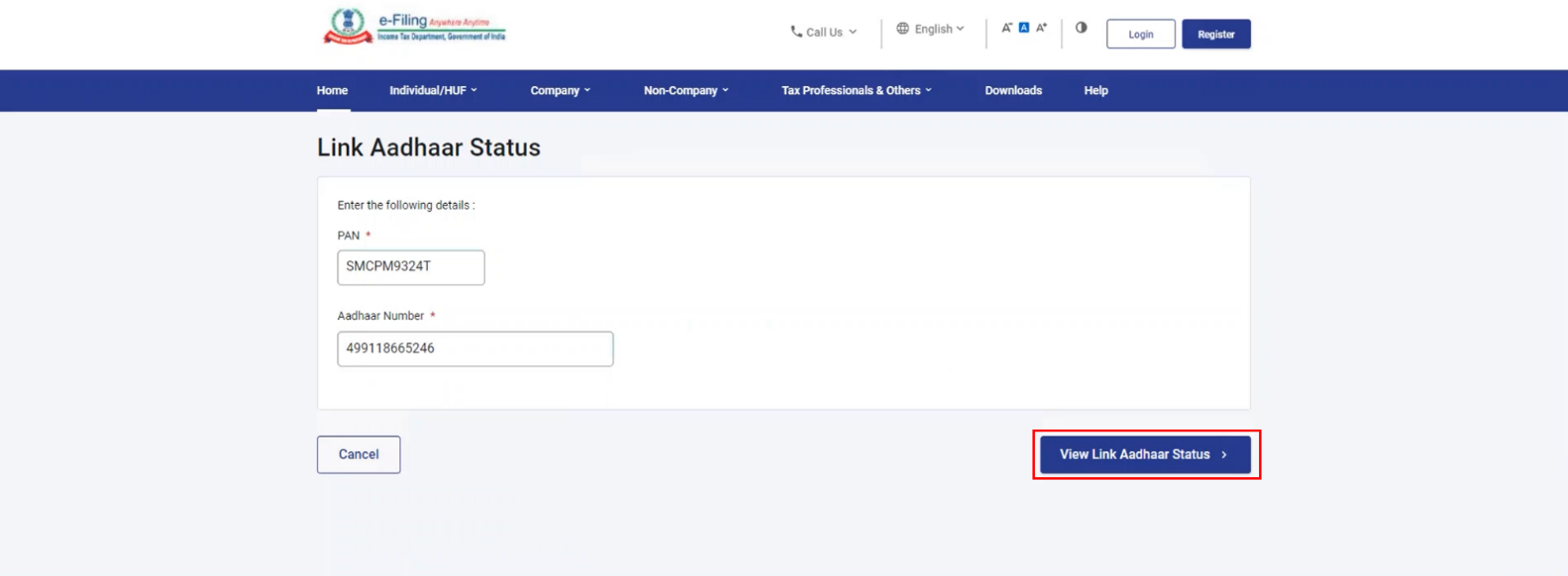

- Enter you PAN and Aadhar in the respective fields

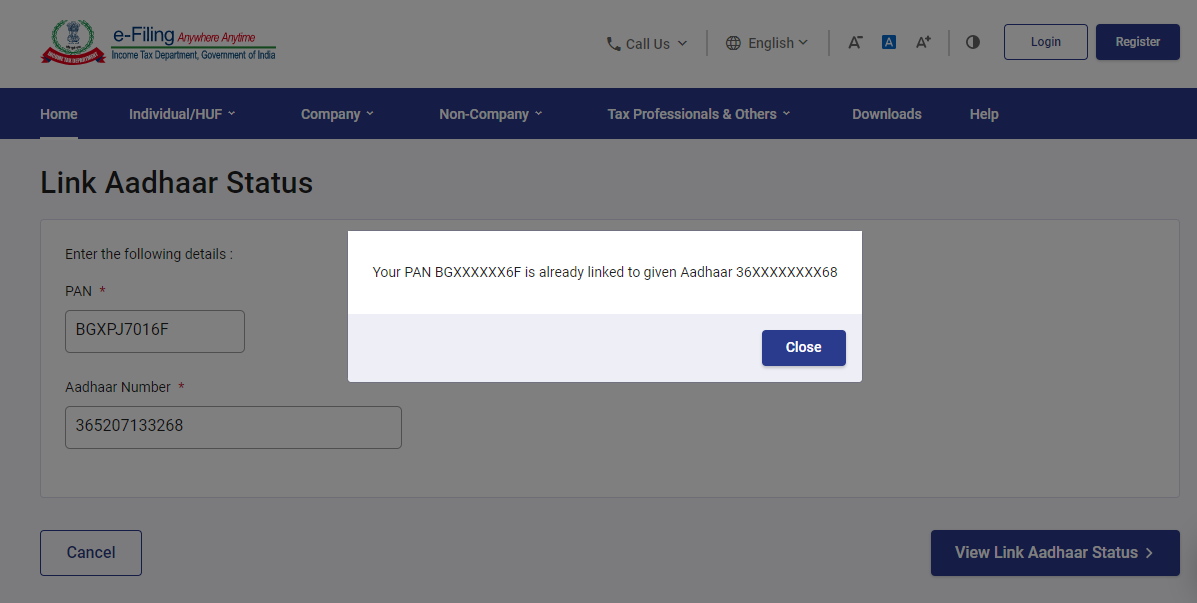

- If your PAN and Aadhar are linked, then you will get a popup as shown below. If you got this, congratulations!!! You saved 1000rs and some effort

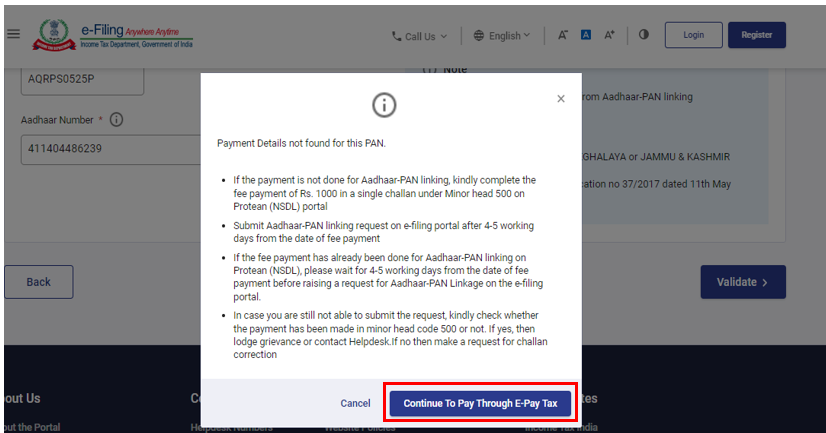

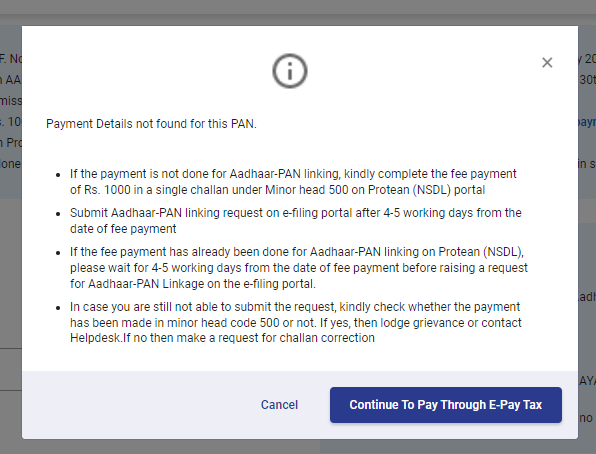

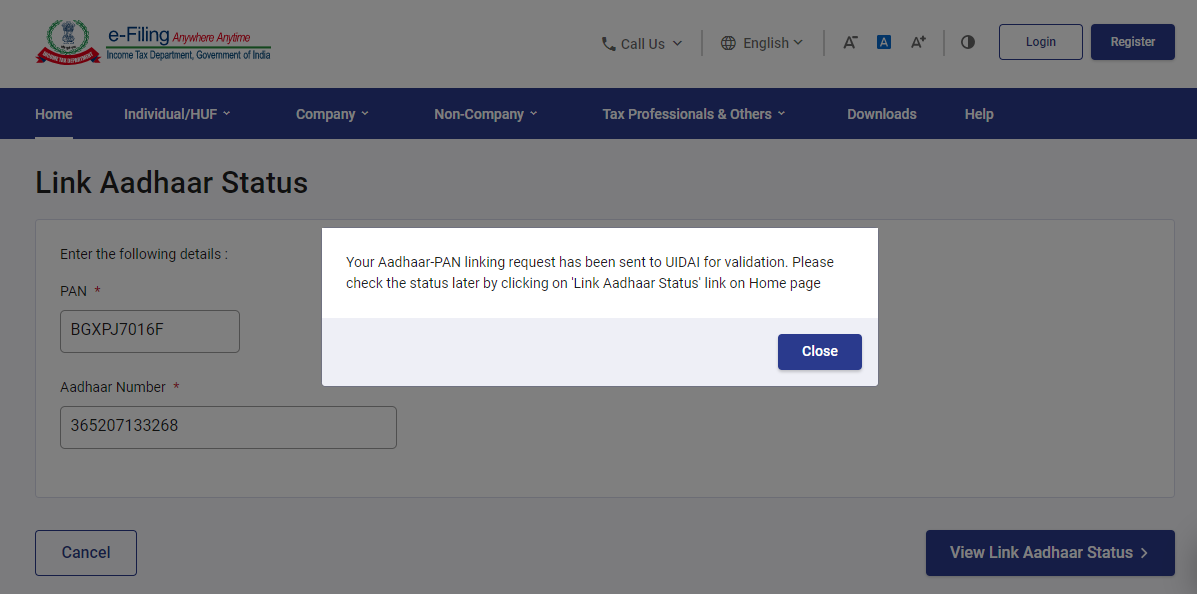

- If you got a different popup as seen below, not to worry Coconuts got you. the further steps are to pay the fine and Link

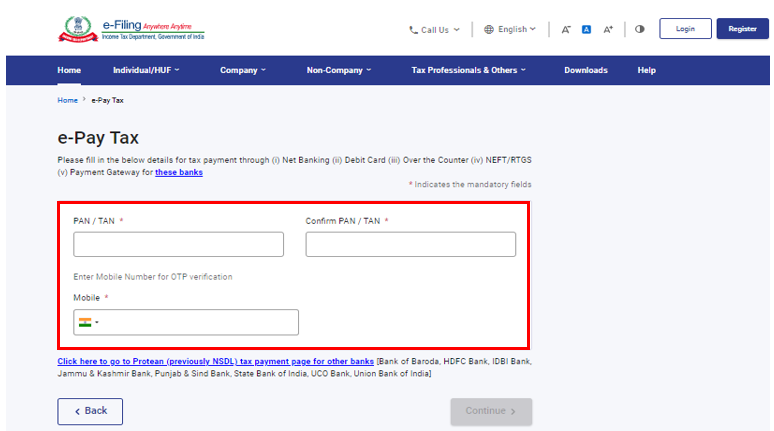

- Enter your PAN in the first input box, enter the same in second box to confirm PAN and your 10 digit Mobile number to receive OTP

- Once you verify with the OTP you will be redirected to the e-pay tax page. Click on Continue

- Check the boxed tile in below image. Click on Proceed in the Income Tax tile

- Select AY (2023-24) and Type of Payment as Other Receipts (500) and then click on Continue

- The fine amount will show up as pre-filled in the next window as seen below. Clock on Continue

Now, challan will be generated. On the next screen you have to select the mode of payment after selecting the mode of payment you will be re-directed to the Bank website where you can make the payment.

It is better to pay with any of the below mentioned Authorized Banks as the further steps can be sped up. Continue from Step 2(a)

Authorized Banks: Axis Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, City Union Bank, Federal Bank, ICICI Bank, IDBI Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Jammu & Kashmir Bank, Karur Vysya Bank, Kotak Mahindra Bank, Punjab National Bank, UCO Bank Union Bank of India. (as on 13.01.2023)

If you have an account in the Bank which is not Authorized for payment through “e-Pay Tax”, you can make payment through Protean (NSDL) Portal as per below steps:

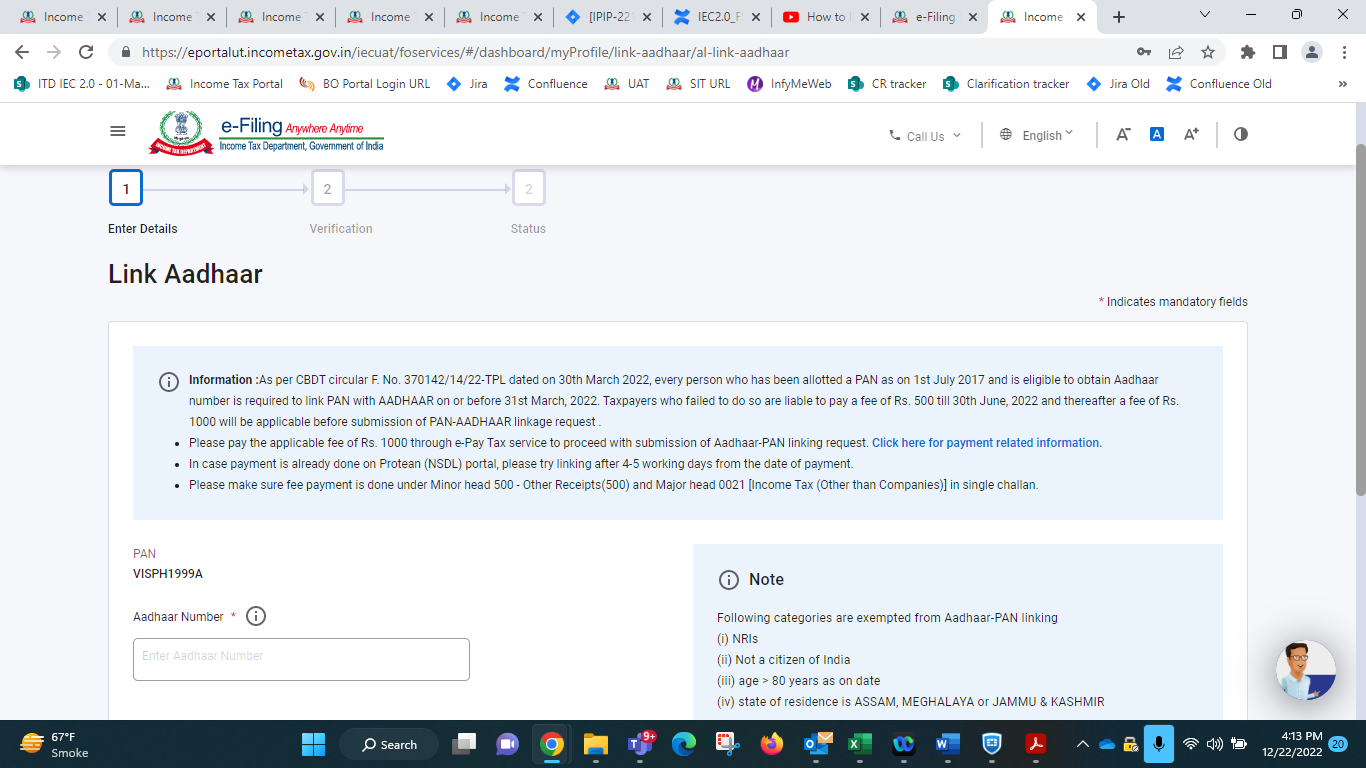

Step:1(a) Visit e-Filing Portal Home page and click on Link Aadhaar in Quick Links section.

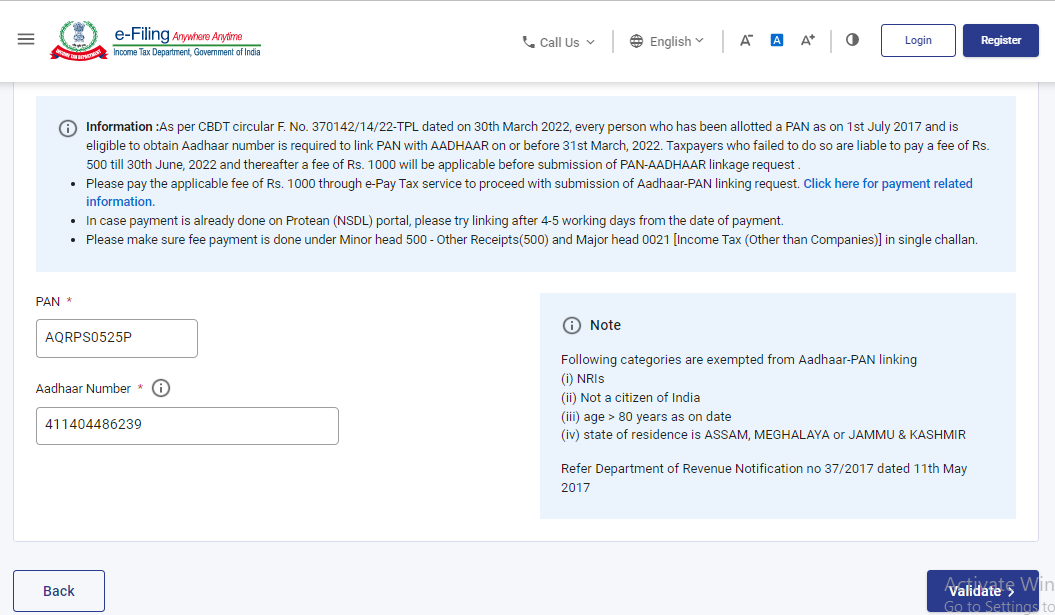

Step:1(b) Enter your PAN and Aadhaar Number and click Continue.

Step:1(c) Click on Continue to Pay Through e-Pay Tax.

Step:1(d) Click on hyperlink given below on e-Pay tax page to redirect to Protean (NSDL) Portal

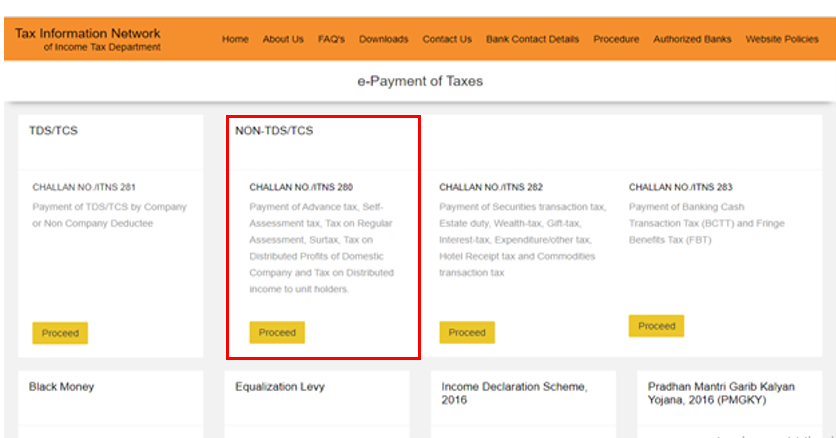

Step:1(e) You will be redirected to Protean (NSDL) Portal. Click Proceed under Challan No./ITNS 280

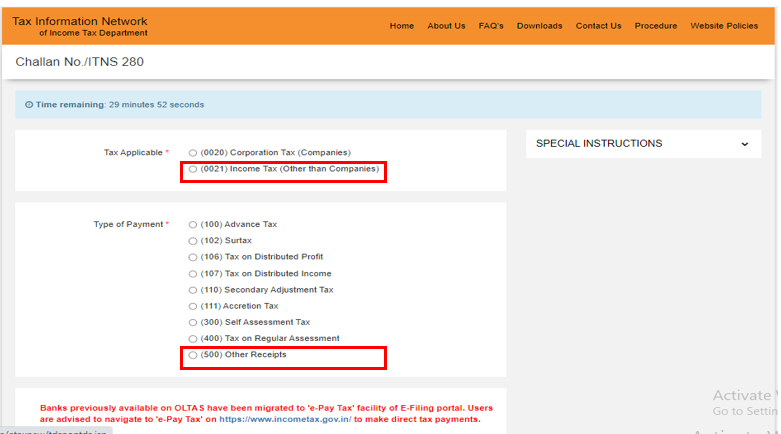

Step:1(f) Select Tax applicable as 0021 and Type of Payment as 500

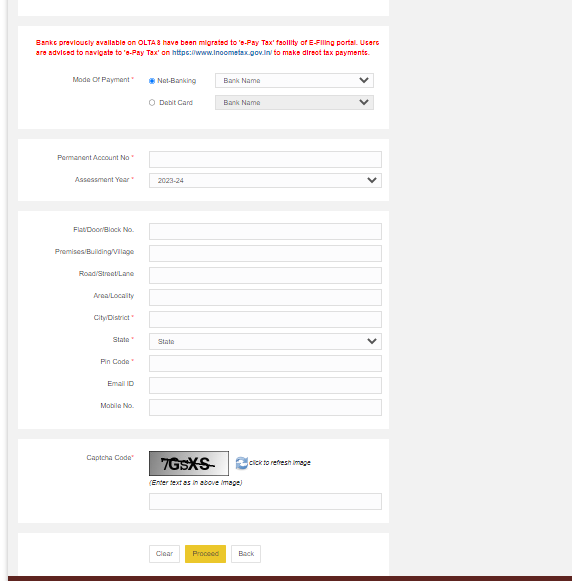

Step:1(g) Provide Assessment Year as 2023-24 and other mandatory details and click on Proceed.

Post payment of fee you can link your Aadhaar with PAN on the e-Filing Portal.

Step 2: Submit the Aadhaar PAN linking request on e-Filling Portal:

Immediately if payment is made through e-Pay Tax service

After 4-5 working days of making of payment if payment is done on Protean (NSDL).

Aadhaar PAN link request can be made in the Post login and Pre login mode.

The steps for each of the mode are detailed below one by one:

Submit Aadhaar PAN link Request (Post login):

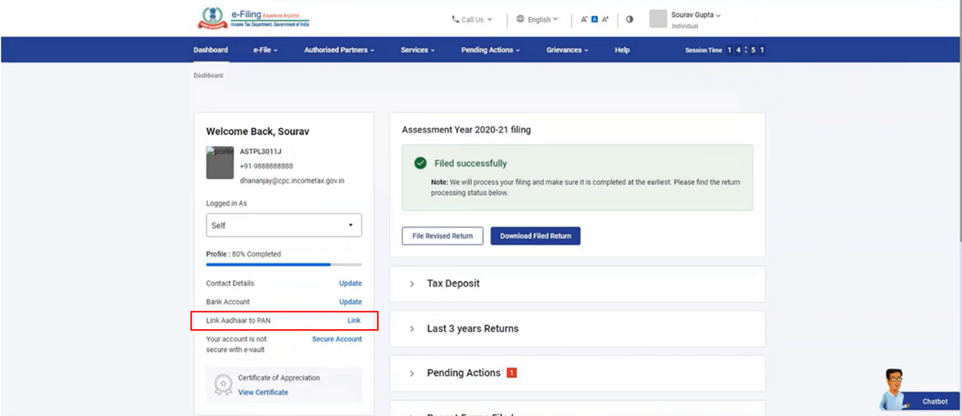

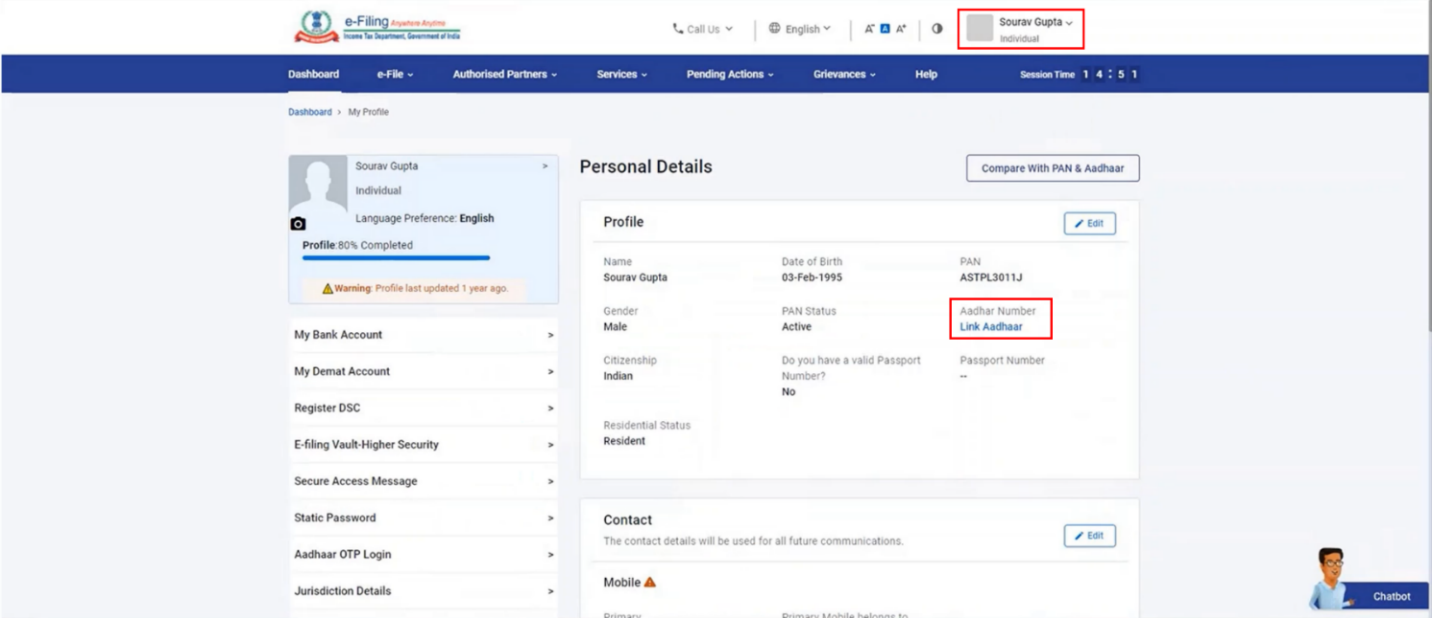

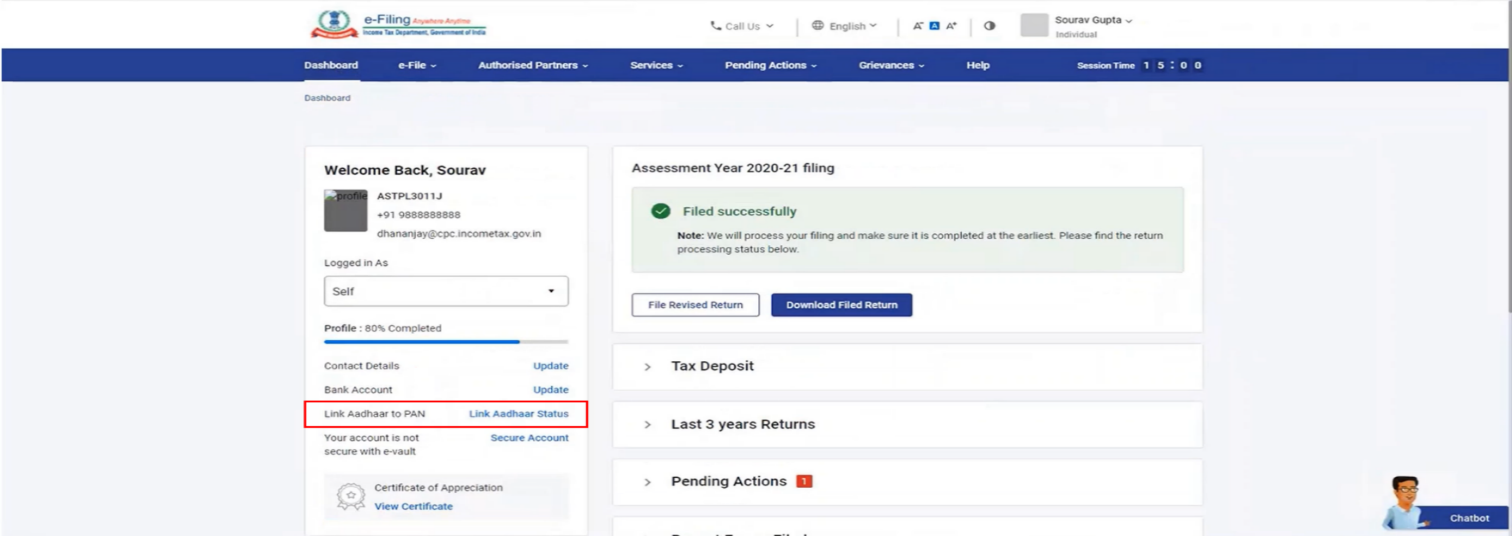

Step 2 (a): Go to https://eportal.incometax.gov.in/ > login > On Dashboard, in Profile Section under the Link Aadhaar to PAN option, click Link Aadhaar.

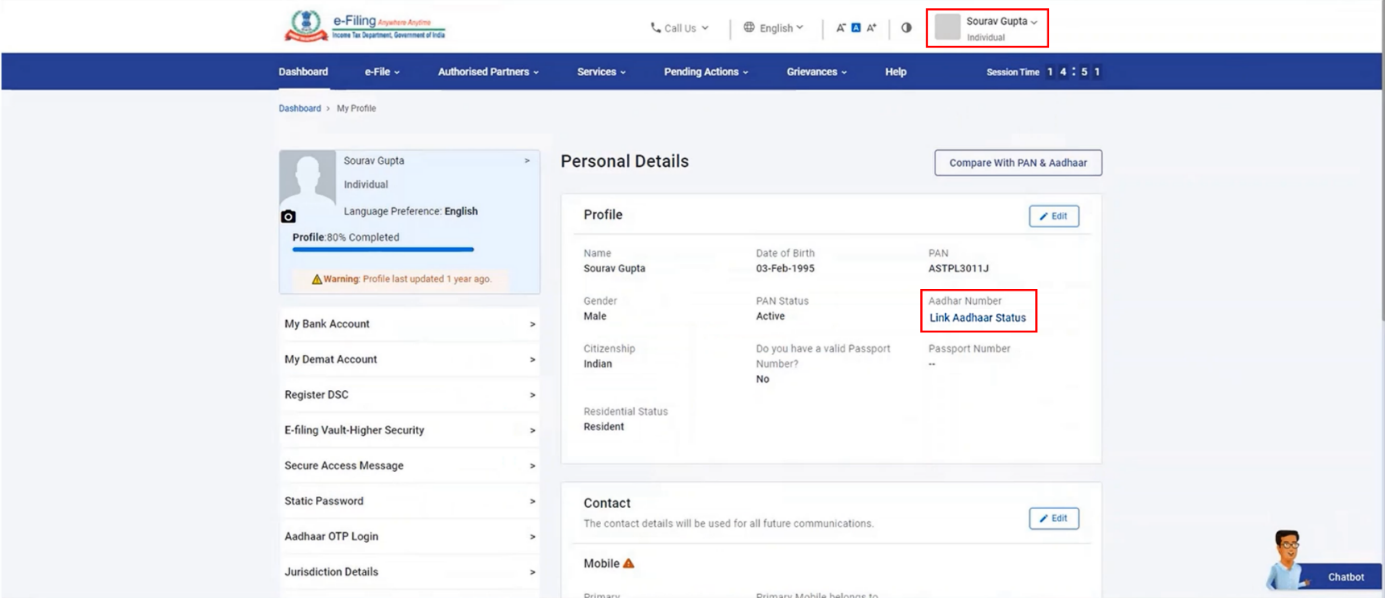

Or alternatively, click on link Aadhaar in personal details section.

Step 2(b) Enter the Aadhaar and click on Validate.

Alternatively, you can submit Aadhaar PAN link Request (Pre-login):

Step 2 (a): Go to e-filing portal home page and click on Link Aadhaar under Quick links.

Step 2 (b): Enter the PAN and Aadhaar and click on Validate.

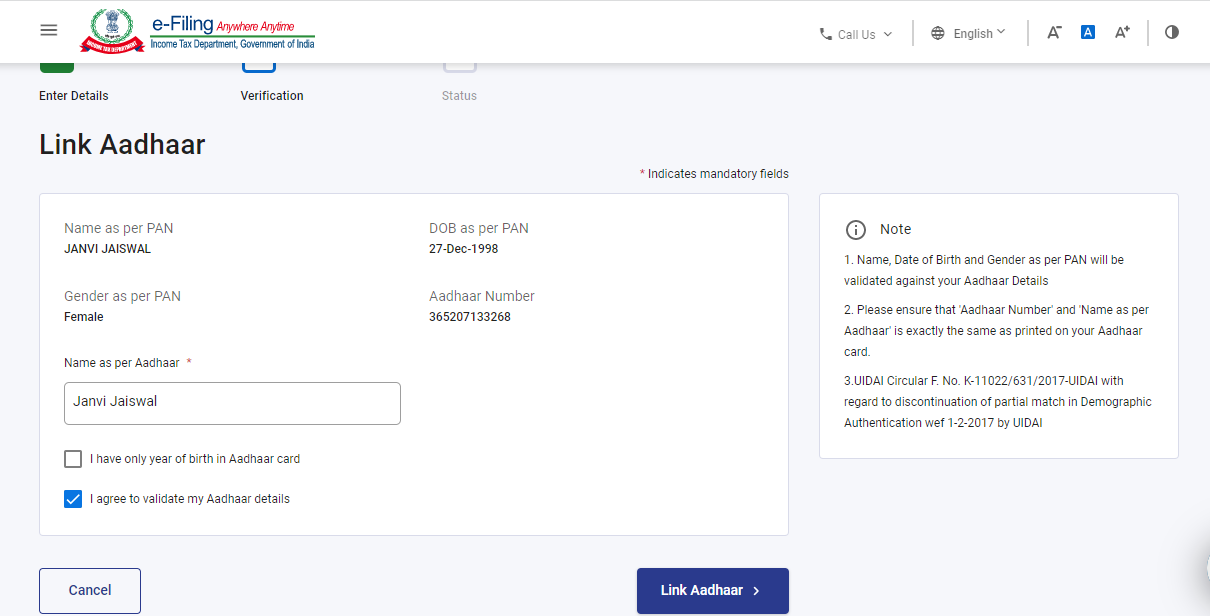

Step 2 (c): Enter the mandatory details as required and click on Link Aadhaar.

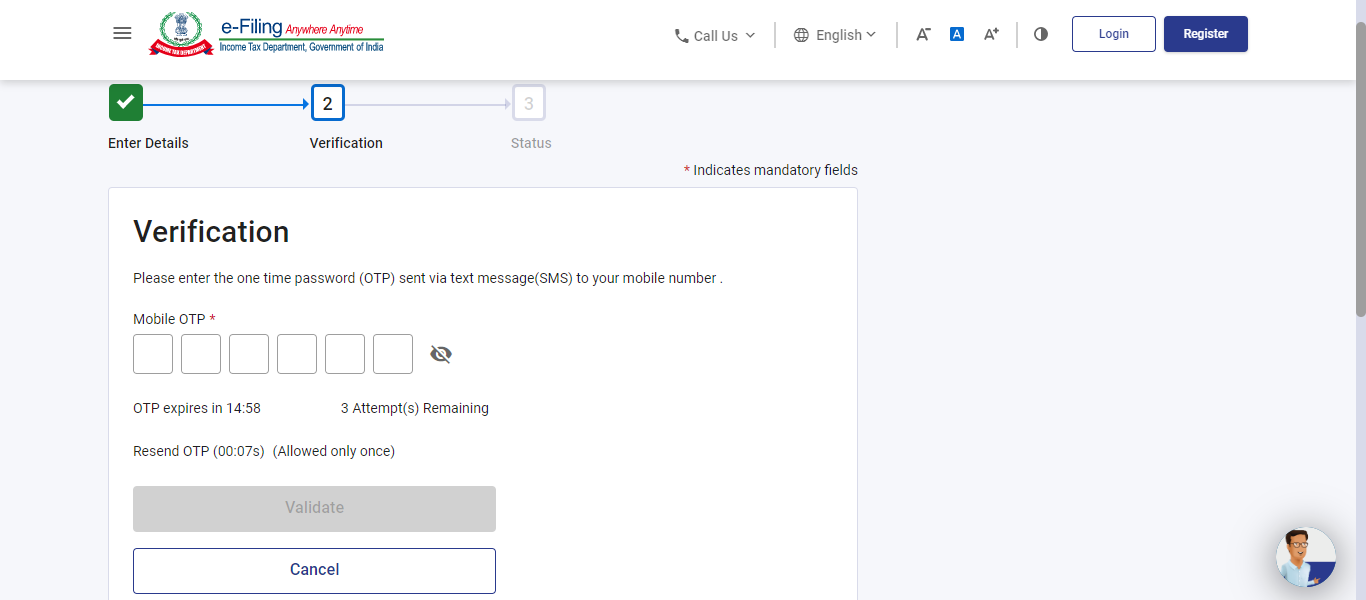

Step-2(d) Enter the 6-digit OTP received on mobile no. mentioned in the previous step and click on Validate.

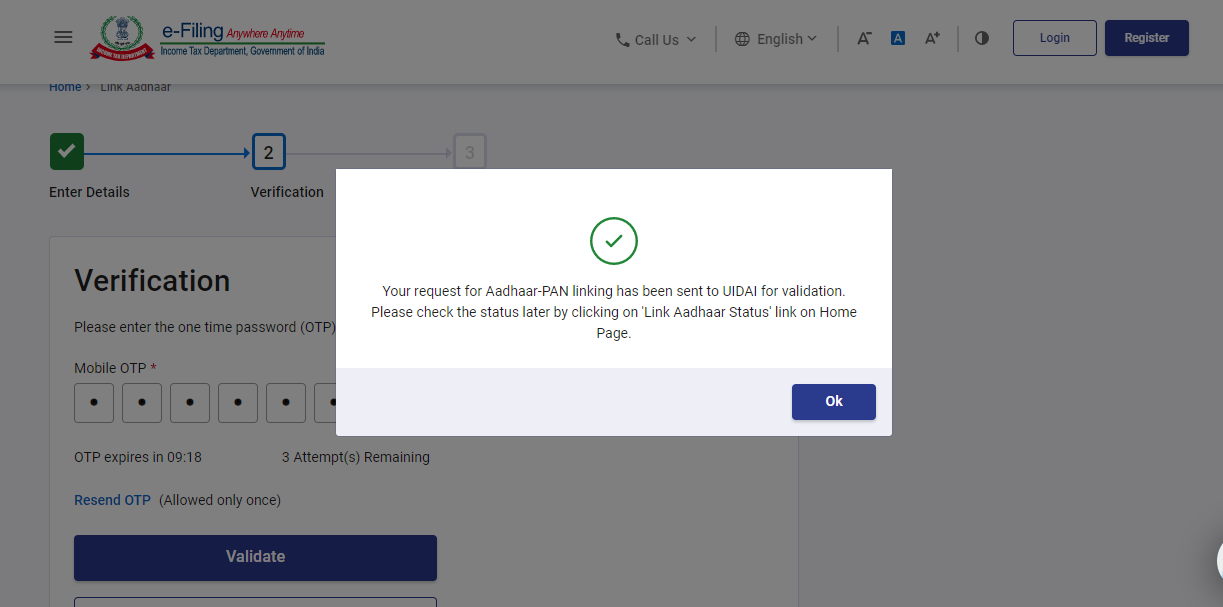

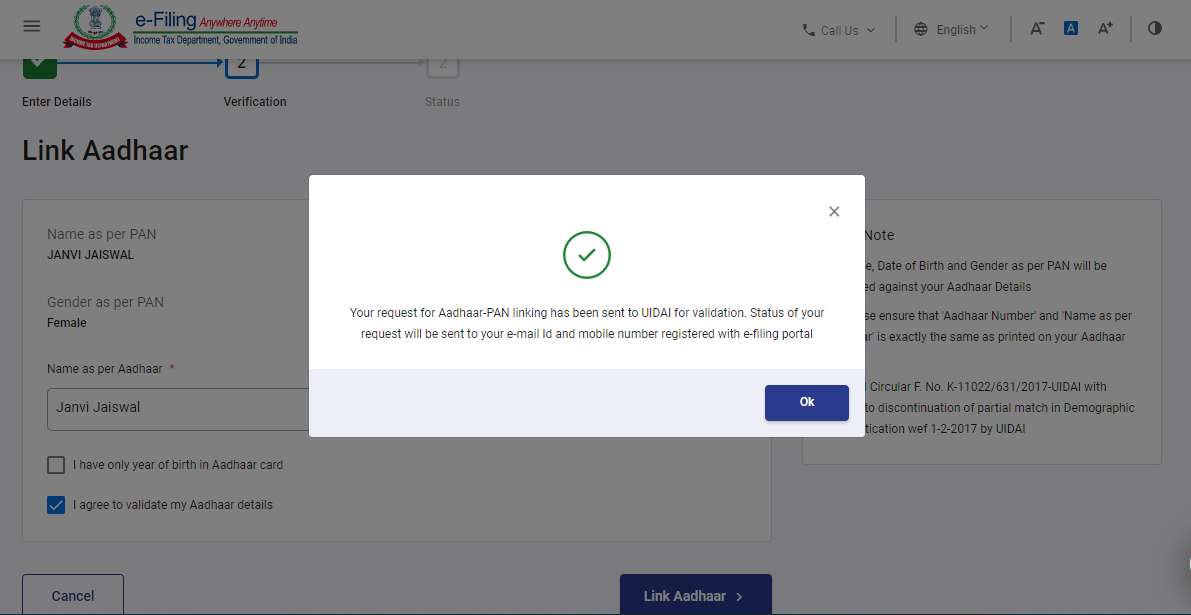

Step:2(e) Request for link of Aadhaar has been submitted successfully, now you can check the Aadhaar-PAN link status.

Scenario-1

If the payment details are not verified on the e-Filing Portal.

Step: (I) After validating PAN and Aadhaar, you will see a pop-up message that

” Payments details not found” click on Continue to Pay Through e-Pay Tax for the payment of fee as payment of fee is the pre-requisite to submit the Aadhaar PAN link request.

Note: If you have already paid the fee on Protean (NSDL) Portal than wait for 4-5 working days after that you can submit the request.

Note: Please ensure you link your correct Aadhaar with your PAN.

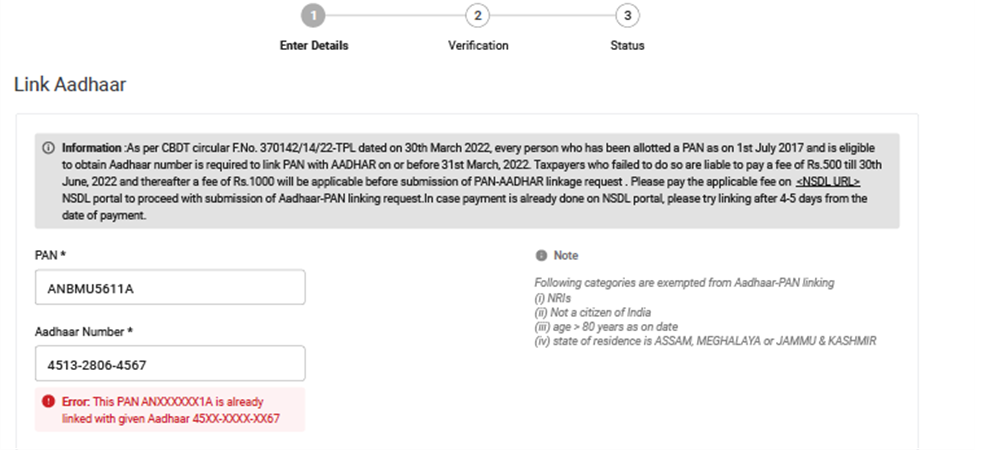

If Aadhaar and PAN are already linked or PAN linked to some other Aadhaar or vice versa, you will get following errors**:**

Scenario-2 PAN is already linked with the Aadhaar or with some other Aadhaar

You may need to contact your Jurisdictional Assessing Officer and submit a request for delinking your Aadhaar with incorrect PAN.

To know your AO’s contact details, visit https://eportal.incometax.gov.in/iec/foservices/#/pre-login/knowYourAO(Prelogin)

or

https://eportal.incometax.gov.in/iec/foservices/#/dashboard/myProfile/jurisdictionDetail (Post login)

After Validating PAN and Aadhaar:

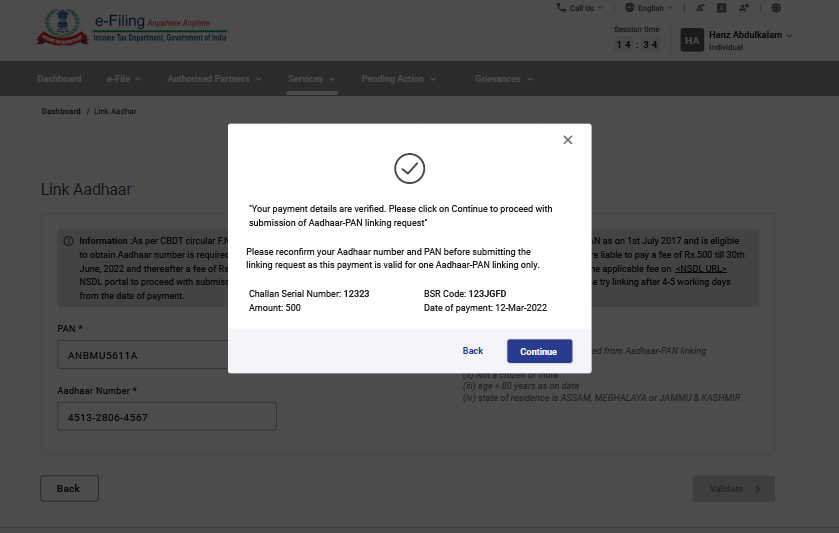

If you have made payment of Challan on Protean (NSDL) Portal and payments details are verified at e-filing Portal.

Step-(i) After validating PAN and Aadhaar you will see a pop-up message that” Your payment details are verified”. Please Click Continue on the pop-up message to submit Aadhaar PAN linking request.

Step-(ii) Enter the required details and click on Link Aadhaar button.

Step:(iii) Request for link of Aadhaar PAN has been submitted successfully, now you can check the Aadhaar PAN link status.

5. View Link Aadhaar Status (Pre-Login)

Step 1: On the e-Filing Portal homepage, under Quick Links click Link Aadhaar Status.

Step 2: Enter your PAN and Aadhaar Number, and click View Link Aadhaar Status.

On successful Validation, a message will be displayed regarding your Link Aadhaar Status.

If the Aadhaar-Pan link is in progress:

If the Aadhaar PAN linking is successful:

5.View Link Aadhaar Status (Post-Login)

Step 1a: On your Dashboard. Click Link Aadhaar Status.

Step 1b: Alternatively, you can go to My Profile > Link Aadhaar Status.

(If your Aadhaar is already linked, Aadhaar number will be displayed. If Aadhaar is not linked Link Aadhaar Status is displayed)

Note:

If the validation fails, click Link Aadhaar on the Status page, and you will need to repeat the steps to link your PAN and Aadhaar.

If your request to link PAN and Aadhaar is pending with UIDAI for validation, you will need to check the status later.

You may need to contact the Jurisdictional AO to delink Aadhaar and PAN if:

- your Aadhaar is linked with some other PAN

- your PAN is linked with some other Aadhaar

On successful validation, you will get a message regarding your Link Aadhaar status.